Tuesday, December 15, 2020

What to expect from Accenture’s share price ahead of earnings

By Century Financial in 'Brainy Bull'

On 4 December, Accenture’s [ACN] share price surpassed the $250 milestone for the first time when it reached an intraday high of $253.46 on 4 December, before closing marginally lower at $253.44. This marked a 22.3% year-to-date increase for Accenture’s share price, and a 78.5% increase from its March low. That said, Accenture’s share price performance has been modest compared to many other tech companies, and the stock has lagged behind the growth of the wider Nasdaq Composite. In fact, at its last close on 11 December, the stock was up 16.98% for the year to date at $245.83, but almost 20% behind that of the tech-laden index.

On 23 March, Accenture’s share price hit a 52-week low when it fell to $137.15 during intraday trading, before closing at $141.97, down 31.5% year-to-date. Accenture’s share price didn’t fully recover until it announced its third-quarter results on 25 June, which helped boost the stock to close at $215.68. This marked a 7.7% increase from the previous day, and was the highest ever close for Accenture’s share price at the time.

As the company prepares its first-quarter earnings report for the fiscal year 2021, due 17 December, can investors expect Accenture’s share price growth to continue?

How has Accenture been performing?

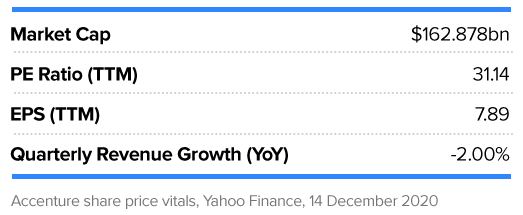

When Accenture released its fourth-quarter results on 24 September, it posted earnings of $1.70 per share, adjusted for non-recurring items, compared to the $1.74 per share a year prior. This marked a negative surprise on the Zacks Equity Research consensus estimate of $1.74, and a year-over-year decline of 2.3%. This is also the first quarter in the last four that Accenture did not produce an earnings beat.

The report included a note saying that the decline came as a result of lower revenue and operating results as well as a higher effective tax rate, but was partially offset by higher non-operating income and lower share count.

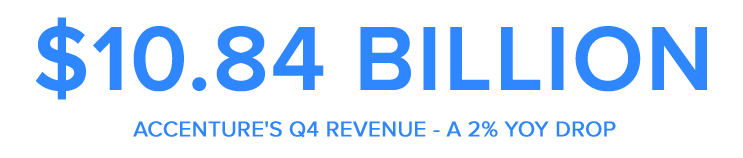

For the quarter ended August, revenues totalled $10.84bn, which missed consensus estimates by 0.67% and marked a year-over-year decline of 2.0% from 2019’s fourth-quarter revenues of $11.06bn.

Despite the slightly disappointing results, the report had little visible effect on Accenture’s share price. On 25 September, the day after the results were released, the stock closed 0.1% higher than the previous session

Looking ahead to the upcoming earnings report, Accenture is expected to post earnings of $2.04 per share, which would represent a year-over-year decline of 2.4%. Meanwhile, revenues are expected to reach $11.38bn, which would mark a minimal growth of 0.2% year-on-year.

For the full year, analysts are calling for earnings of $8.03 per share and revenues of $46.73bn, which would represent respective growths of 7.6% and 5.4% year-over-year.

Is Accenture an ace stock?

James Friedman, analyst at Susquehanna, recently pointed out that there are some “encouraging industry-level signs” that could stand to favour Accenture, in a note seen by Seeking Alpha. That said, he also highlighted that some software partners have been “hitting air pockets”, which could be a potential risk.

Friedman downgraded Accenture to Neutral from Positive, with a $250 price target, reported The Fly.

This followed the recent rally, which pushed Accenture’s share price above Friedman’s price target, and in turn saw him to step to the sidelines and await a better entry point.

The consensus among 29 analysts polled by CNN Money is to Buy the stock. A majority of 15 analysts hold this rating, while 11 suggest to Hold. Meanwhile, one analyst rates Accenture as Outperform, and the remaining two rate it Underperform.

The 25 analysts offering 12-month share price forecasts on CNN Money provided a median target of $250, with a high of $278 and a low of $207. The median target would represent a 1.7% increase on Accenture’s share price as of close on 11 December.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.