Thursday, October 05, 2023

Tech Triumphs: The 2023 IPO Tales of Arm and Instacart

By Century Financial in 'Blog'

.jpg)

Synopsis:

In 2023, global IPOs declined, but tech firms like Arm and Instacart stood out. Arm's IPO reached a notable $65 billion valuation, while Instacart navigated valuation challenges to secure $10 billion. Their stories underscore the importance of adaptability in a shifting financial landscape.

An initial public offering (IPO) refers to offering shares of a private corporation to the public in a new stock issuance for the first time. An IPO allows a company to raise equity capital from public investors.

The IPO Landscape:

The first half of 2023 recorded 615 IPOs with US $60.9b capital raised, a 5% and 36% decrease year-over-year (YOY), respectively. However, some emerging markets are booming with IPO activities, as they benefited from the global demand for rich mineral resources, their vast population, growing unicorns or entrepreneurial SMEs.

The technology sector has continued to be the leading sector in IPO activities to date in 2023.

Valuation of IPO

The valuation of the IPO is done by its investment bankers or underwriters. These entities go through the company’s financials, like the assets, liabilities, performance, and the ability to generate revenue. The data is carefully analysed over a period and is sent for an audit.

They carefully consider few factors to find a fair valuation for the IPO

Why do firms go for an IPO?

The main reason for a company to launch its share in the public is to raise capital for business.

But the story is more than that.

If the existing investors wish to liquidate their interest partially or entirely, listing on a stock exchange can provide a solution.

A successful IPO provides a company with value, reputation, status, and additional finances for funding any merger and acquisition deals.

Mentioned are the recently popular IPOs released.

The Much-awaited Tech IPO

The entrance of the chip designer and an initial public offering (IPO) that caught the eye of the biggest tech companies, Apple, Samsung, and Intel, all signalled their interest.

It was the ARM IPO

The Rise of Instacart

Founded in 2012, Instacart delivers groceries from chains including Kroger, Costco and Wegmans and had to drop its stock price dramatically to make it appealing to public market investors.

The bulk of Instacart’s competition comes from Amazon and big brick-and-mortar retailers like Target and Walmart.

Some key statistics***

InstaCart IPO

Grocery delivery app Instacart bumped its per-share proposed IPO price range from $26 to $28 to $28 to $30, raising its total valuation to $10 billion and the boost in Instacart's IPO price range comes after Arm's IPO, which led to 25% gains on its first day of trading.

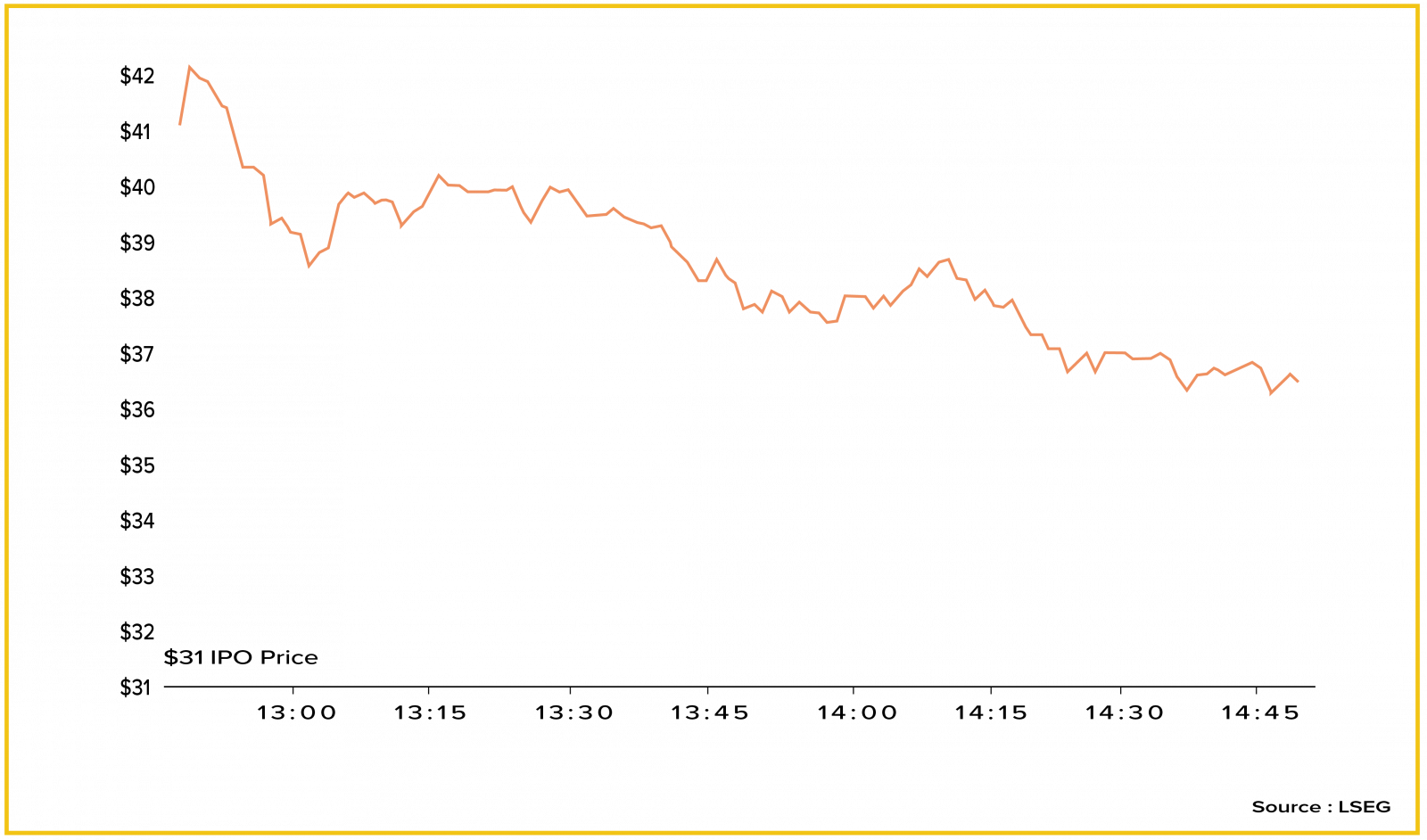

Instacart in its first day on Wall Street

The stock closed at $33.70 after hitting a high of $42.95.

.png)

Recap

In 2023, while many new companies found it harder to start on the stock market, tech companies like Arm did well. Instacart's ups and downs show the challenges new businesses face today. Both remind us that being flexible and creative is key in changing times.

Century Financial Consultancy LLC (CFC) is duly licensed and regulated by the Securities and Commodities Authority of UAE (SCA) under license numbers 2020000028 and 301044, to practice the activities of Trading broker in the international markets, Trading broker of the Over-The-Counter (OTC) derivatives and currencies in the spot market, Introduction, Financial Consultation and Financial Analysis, and Promotion. CFC is a Limited Liability Company incorporated under the laws of the UAE and registered with the Department of Economic Development of Dubai (registration number 768189).

CFC may provide research reports, analysis, opinions, forecasts, or information (collectively referred to as Information) through CFC’s Websites, or third-party websites, or in any of its newsletters, marketing materials, social media, individual and company e-mails, print and digital media, WhatsApp, SMS or other messaging services, letters, and presentations, individual conversations, lectures (including seminars/webinars) or in any other form of verbal or written communication (collectively referred to as Publications).

Any Information provided in this publication is provided only for marketing, educational and/or informational purposes. Under no circumstances is any Information meant to be construed as an offer, recommendation, advice, or solicitation to buy or sell trading positions, securities, or other financial products. CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this Publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the use of the Information.

Please refer to the full risk disclosure mentioned on our website.