Tuesday, February 05, 2019

Zawya – Region’s stock markets make strong start to 2019, Saudi outperforms in January

تم إعداد هذا المنشور من قبل آرون ليسلي جون

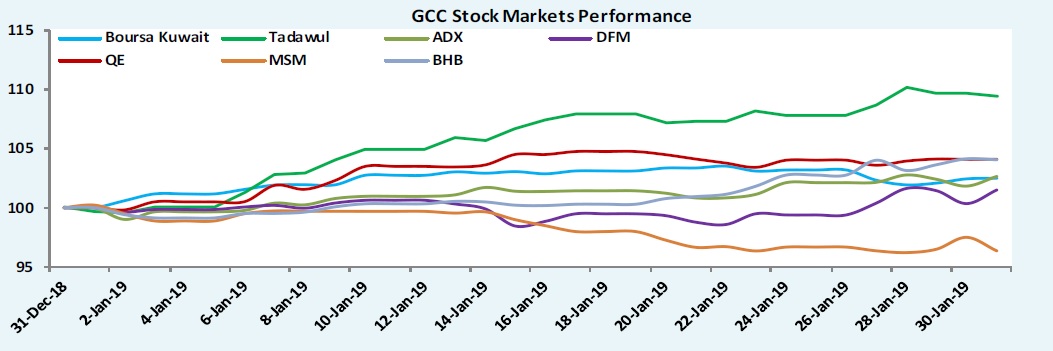

Most Middle East markets rose in January, tracking a surge in oil prices and global markets

Stock markets in the Middle East mostly made strong gains in January, tracking a rise in global markets and oil prices during the month. In most cases, markets were also buoyed by fourth quarter earnings results. Saudi Arabia and Egypt’s indices outperformed the region, while Oman’s index was the sole loser among its peers in the Gulf.

MSCI’s World Index, a major global stock index which tracks shares in 47 countries, added 7.8 percent in January, data from Eikon showed.

On top of to that, the United States imposed sanctions on Venezuelan state-owned oil firm PDVSA, curbing its exports to the U.S. and tightening supply further.

Saudi Arabia

Saudi Arabia’s stock market index was the top performer in the region, adding 9.37 percent in January.

“We believe foreigners are positioning themselves aggressively before FTSE and MSCI actual inclusion later this year in tranches,” Nishit Lakhotia, head of research at Bahrain-based investment bank SICO, told Zawya by email.

The awaited inclusion of the Saudi market in the MSCI and FTSE Russell emerging market indices later this year, is expected to attract billions of dollars from foreign funds to the market – both passive and active funds.

In June 2018, MSCI said it would upgrade the kingdom to emerging market status in phases from mid-2019. Tadawul is also poised to be included on the FTSE Russell index from March this year.

Lakhotia said that other factors “such as increasing traction on mega projects such as Neom” and the strength in oil prices have helped the Saudi index.

Neom, the planned $500 billion mega-city set to be built in the northwest of the Kingdom, is part of Crown Prince Mohammed bin Salman’s Vision 2030 plan that aims to attract foreign investment, create jobs and move the country away from oil dependency.

Saudi Arabia announced in January 2019 that it has established a closed joint-stock company to develop Neom. The company will be fully owned by the Public Investment Fund, the sovereign wealth fund of Saudi Arabia.

Lakhotia said that gains were made despite “a more or less weak 4Q (fourth quarter) earnings till date across petrochemicals and banks”.

Saudi Basic Industries Corp (SABIC), the world’s fourth-largest petrochemicals maker and the biggest stock on the exchange, missed analysts’ forecasts with a 12.4 percent year-on-year profit drop in Q4 2018.

“Looking ahead, we believe (the) Saudi market may continue to exhibit momentum in the coming weeks, which may likely be flow-driven rally ahead of inclusions from FTSE and MSCI,” Lakhotia said.

The Saudi index rose 8.4 percent in 2018.

(Source: KAMCO Research, GCC stock exchanges).

Egypt

Egypt’s blue-chip EGX30 index was the second-best performer in the region, adding 8.37 percent in January, just behind Saudi Arabia’s index.

Commercial International Bank announced early in January that its board of directors has approved a capital increase to 50 billion Egyptian pounds ($2.8 billion), up from 20 billion pounds.

Other top performers were Global Telecom Holding, Talat Moustafa Group, Egypt Kuwait Holding and EFG Hermes, which rallied 21.5 percent, 15 percent, 17.4 percent and 12.4 percent respectively.

Century Financial Brokers’ John said that Global Telecom Holding rallied “on account of the news that it will be taken private”. The company’s major shareholder, Dutch telecoms firm Veon, said in January that it had agreed a new funding line for Global Telecom and was considering taking the company private. It announced a $600 million offer for the 42.3 percent of the company it does not already own on Tuesday.

“Improving macro-economic scenario of Egyptian economy is the reason behind the general bullishness in stocks as the latest inflation rate in Egypt dropped to 11.1 percent (in December 2018) from 15.6 percentage in the previous month,” John said.

The Central Bank of Egypt had left rates unchanged at its December meeting, before the positive inflation figures. A plunge in inflation contributed to expectations the central bank could cut rates at its February meeting.

“The reduction in inflation rate will help the Central Bank of Egypt to take a dovish stance and cut the rates in its 14th February, 2019 meeting,” John added.

A rally in emerging markets also boosted the Egyptian market during the month. Data from Eikon shows that the MSCI Emerging Markets Index gained 8.73 percent in January.

“With global economic forecasts showing slower growth this year and major central banks toning down their rhetoric, we believe Egyptian monetary authorities might indeed cut the rates this time. This could prompt a further rally in equities and this month EGX 30 can touch the 15,000 mark,” John said. EGX30 was last trading at the 14,364 mark on Monday at 16:12 GST.

The United States’ Federal Reserve said in its meeting held in the last week of January that it would be “patient” before making any further moves on interest rates, confirming its dovish stance. The Fed also announced that it would hold rates steady.

The International Monetary Fund (IMF) cut its global growth forecast for 2019 to 3.5 percent, from the 3.7 percent it had predicted in October and down from the 3.7 percent predicted for 2018. The main concern that led to the lower growth forecast was the slowdown in the Chinese economy.

Egypt’s blue-chip index EGX30 finished the year 2018 13.2 percent lower.

United Arab Emirates

Stock markets in Dubai and Abu Dhabi added 1.5 percent and 2.64 percent respectively in January.

SICO’s Lakhotia said that Dubai’s index performed reasonably well, “barring negative performance by three key stocks – Emaar Malls (-12% month-on-month), Damac Properties (-13% month-on-month) and Emaar Development (-9% month-on-month),” adding that market participants anticipate that all three could be excluded from MSCI’s index in the next review in May.

Index provider MSCI said that its next semi-annual index review, will be announced on May 14, 2019 and the effective date for its rebalancing will be on June 3, 2019.

Lakhotia also noted that daily turnover on the Dubai financial market fell sharply to only $32 million, which was a 63 percent year-on-year decline on January 2018.

“As dividend announcements are expected in Feb-March, we believe the market activity (is) likely to gain further traction from here in the coming weeks, pushing the index higher.”

The surge on the Abu Dhabi stock market was mainly led by banks and financial institutions. Shares in First Abu Dhabi Bank (FAB), the UAE’s largest bank, added 4.54 percent in January. Lakhotia said on FAB that “possibly investors positioned themselves ahead of dividends”.

FAB announced a 3.9 percent increase in Q4 2018 net profit and a 10 percent increase in net profit for the whole of 2018. The bank’s board has proposed a cash dividend of 74 UAE fils per share and raising its foreign ownership limit to 40 percent, up from 25 percent currently.

“We believe the news on FAB’s foreign ownership limit increase as a catalyst in the short term, as it will likely lead to higher flows from weight increase in the MSCI review,” Lakhotia said.

“Further, ADCB and UNB saw lot of traction led by merger ratio announcement towards the end (of January).”

On January 29, Abu Dhabi Commercial Bank (ADCB) and Union National Bank (UNB) announced that they had agreed to merge, and that the combined entity will acquire Al Hilal Bank.

“Abu Dhabi market will continue to be dictated on how traders and investors want to position in the banking sector,” SICO’s Lakhotia said.

Abu Dhabi’s index gained 10.7 percent during the year 2018, while Dubai’s index dropped 25.8 percent.

Qatar

Qatar’s index added 4.1 percent in January.

The real estate sector was the main driver for the Qatari market as the MSCI Qatar real estate index rose 12.6 percent, according to data from Eikon. Ezdan Holding Group gained 20.4 percent and United Development Company rose 13.8 percent.

“Trading activity on the exchange was mixed during the month. Monthly volume (of stocks) traded declined by 8.9% to reach 218.3 Mn (million) shares in January-19m as compared to 239.7 Mn shares during the previous month,” Kamco Research said in a report sent to the media.

“On the other hand, monthly value traded gained 10.2% to reach QAR 5.8bn (Qatari riyals, or $1.59 billion) as compared to QAR 5.3bn during the previous month,” the Kamco report added.

Shares in Qatar National Bank (QNB), the largest bank by assets in the Middle East and Africa, rose 1.53 percent during January. QNB recorded a 5 percent increase in 2018 yearly net profit, “despite the impact of the Turkish Lira devaluation,” KAMCO research’s report said.

Investors were concerned last year about banks with exposure to Turkey following a run on its currency, the lira, in August. Although a recovery was made, the lira finished the year 28.4 percent lower against the U.S. dollar, according to data from Eikon.

QNB completed in 2016 the acquisition of Turkey’s Finansbank. Currently, around 15 percent of QNB’s assets and 14 percent of its loans relate to Turkey, according to Arqaam Capital.

In 2018, the Qatari index was the best performer among its peers in the region, gaining 20.83 percent.

Oman

Oman’s index was the sole loser in January, dropping 3.6 percent.

“The MSM 30 index continued to slide in the New Year with the index reaching a new record low,” Kamco Research’s report said. It said the benchmark reached its lowest point since 2005 on January 29, but then made a marginal recovery in the last two trading sessions to close the month at 4,166.47 points.

The biggest losers on the exchange in January were Voltamp Energy, Al Madina Takaful and Omantel with declines of 9.13 percent, 8.51 percent and 7.73 percent respectively.

The top gainers, on the other hand, were Dhofar International Development and Investment Holding, Oman Investment & Finance, and United Finance with gains of 7.14 percent, 5.19 percent and 3.45 percent respectively.

“Trading activity in the equity market improved during the month on the back of higher selling activity on the exchange. Total volume of shares traded on the exchange gained marginally by 1.6% to reach 261.7 mn shares in January-19 as compared to 257.6 mn shares in December-18,” Kamco’s report added.

For the year 2018, Oman’s stock market index dropped 15.2 percent.

Kuwait

Kuwait’s Premier Market index gained 3.1 percent in January.

On April 1 2018, Kuwait divided its stock market into three segments as part of a reform programme aimed at improving the attractiveness of the exchange to investors. The three market segments are the premier market, the main market and the auction market.

During the month of January, 11 out of the 17 stocks on the premier market index made gains.

“Trading activity remained positive during the month with gains in both volume and value traded. Monthly volume of shares traded surged almost 60 percent to 4 bn shares on the back of higher trades in small-cap stocks.,” Kamco Research said in its monthly report.

According to a Reuters poll of twelve leading fund managers, 58 per cent of participants expect to raise their equity allocation to the Kuwaiti market over the next three months and only 8 per cent expect to cut them.

Investors will be awaiting in mid-2019 a decision by MSCI to upgrade the market to its emerging market status. The market joined the FTSE Russell Emerging Market Index in two phases starting in the last week of September 2018, with the second phase occurring in December.

For the year 2018, Kuwait’s stock market index added 9.94 percent.

Bahrain

Bahrain’s stock market was the third-best performer in the Gulf, behind Saudi Arabia and Qatar, as the Bahraini index added 4.05 percent in January.

Shares in Ahli United Bank (AUB), the largest bank in terms of market capitalisation in Bahrain, rose 10.22 percent during the month, boosting the Bahraini bourse.

“Shares of AUB got a boost after the bank agreed to merge with KFH (Kuwait Finance House) to create the largest banking entity in Kuwait, with assets of about USD 94 bn, and the sixth-largest bank in the gulf region,” the Kamco Research report said.

The two banks announced in January 2019 that they had agreed to merge, having been in talks since mid-2018. The Bahraini and Kuwaiti lenders said the deal is subject to completion of due diligence and required approvals by regulators. Shares in National Bank of Bahrain (NBOB) rose 9.02 percent in January, as the bank reported a 14.9 percent increase in full year 2018 net profit.

Source: Zawya.

__511674160.jpg)

__1302024813.jpg)

__1878767494.jpg)

__1738963817.jpg)

__1225849453.jpg)